News & Events

How will the recently announced Stamp Duty Holiday affect you

25th August 2020

One of the parts of the Chancellor’s the recent Summer Statement that garnered the bulk of the coverage is the ‘stamp duty holiday’ for house buyers in England and Northern Ireland (Scotland and Wales weren’t initially included but the Scottish Parliament and Welsh Assembly have subsequently made similar announcements).

What is stamp duty?

Stamp duty – or Stamp Duty Land Tax to give it its full title – is a tax you need to pay when you buy a residential property or a piece of land in England or Northern Ireland (Scotland and Wales have their own stamp duty rules). The tax is paid when the sale is completed and is based on the price paid for the property.

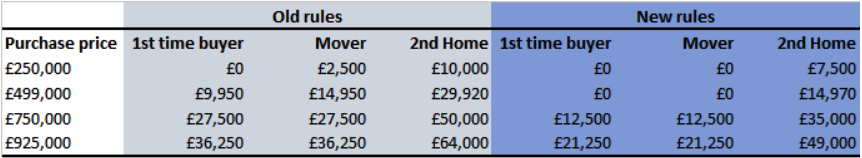

Before the ‘stamp duty holiday’ was announced there were three different points at which stamp duty was payable, depending on whether you were a first-time buyer, moving house or a second home owner.

For movers, stamp duty had to be paid on any property costing more than £125,000.

For first-time buyers there was no stamp duty to pay unless a property cost more than £300,000. If your first home cost more than £500,000 you paid the same as a mover but if it cost less than that, you only paid tax on the part of the price that fell between £300,000 and £500,000.

For those buying a second home, they would pay the same as a mover plus an extra 3%.

What’s changed?

In his summer statement Rishi Sunak announced that from 8th July 2020 to the 31st March 2021 home buyers will no longer pay stamp duty on the first £500,000 of a property purchase. Then for anything between £500,000 and £925,000, the rate will be 5%.

For home buyers this is all very straightforward (and has – according to figures – already sparked a positive reaction in the UK housing market) but it’s taken a bit longer to unravel what this means for investors. The holiday does apply to buy-to-let and second home purchases, but the treasury has confirmed the 3% surcharge will still apply.

How will the changes impact on you?

The cut will have an immediate impact for anyone buying a property over the old thresholds.

For most first time buyers it won’t have much of an impact, unless they are in the south-east as a first home is unlikely to cost more than £300,000 anywhere else in the country (although ironically it is likely that the biggest savings will be made in London and the South East as property prices are so much higher than the rest of the country).

The biggest savings will be at the lower end of the market and the table below shows the savings you could make under the new scheme:

As we’ve said the initial signs are the cut has promoted a positive reaction and transactions have risen sharply in the four weeks since the announcement. The worry now is that sales could fall just sharply when the holiday ends on the 1 st April 2021 and causing a damaging slump across the housing market.

If you are thinking about buying a house either for yourself or as an investment and would like to find out more about how the stamp duty holiday (or any other potential tax implications) might affect you, please email mark@rowleys.biz or call Mark Hook on 0116 2827000.