News & Events

Rethinking an inheritance with Deeds of Variation

11th November 2025

The lesser-known estate planning tool

It’s widely assumed that once a Will has been written and a person has passed away, the terms are final. The estate is distributed, and there’s nothing more to be done.In fact, that’s not always true. Families can, sometimes, legally change how an estate is distributed after death with a Deed of Variation (also known as a Deed of Family Arrangement).Rowley’s Partner and Head of Tax, Mark Hook, explains how one of the least-known estate planning tools can be one of the most useful available.

What is a Deed of Variation?

A Deed of Variation allows the beneficiaries of a deceased person’s Will or estate to alter the way the estate is distributed, even after the person’s death.

In practical terms, it lets beneficiaries “rewrite” part of a Will or the intestacy provisions where no Will exists if everyone affected agrees. The new arrangement is then treated, for legal and tax purposes, as if it had been made by the deceased in their original Will.

Families often use a Deed of Variation to make the distribution of an estate fairer, more tax-efficient, or more reflective of the family’s current circumstances.

Why consider a Deed of Variation?

There are several situations where a Deed of Variation can be valuable:

- Tax Planning (especially Inheritance Tax)

Beneficiaries can redirect assets to others in a more tax-efficient way. If completed within two years of the date of death, the variation can reduce Inheritance Tax (IHT) or Capital Gains Tax (CGT) liabilities.

For example, a wealthy beneficiary might pass part of their inheritance to their children or to a trust, reducing the size of their own estate and future IHT exposure.

- Fairness and family harmony

Sometimes a Will unintentionally excludes someone such as a new grandchild or stepchild or divides assets unequally, which can create tension. A Deed of Variation allows beneficiaries to agree to a fairer outcome and help maintain family relationships.

- Changed circumstances

Over time, people’s situations change. A beneficiary may have since passed away, become financially secure, or developed additional needs. A variation allows the estate to better support those who need it most.

- Rectifying mistakes or oversights

If the Will contains an error or omission, a Deed of Variation can correct it without going to court, which is often faster and more cost-effective than formal litigation.

- Providing for someone not named in the Will

A Deed of Variation can also allow beneficiaries to provide for a partner, friend, or carer who was close to the deceased but not included in the Will.

- Asset protection

Assets can be redirected into a trust to protect vulnerable beneficiaries such as minors, people with disabilities, or those facing divorce or bankruptcy.

Important conditions to ensure validity

To be valid, a Deed of Variation must meet several requirements:

- It must be executed within two years of the date of death.

- All affected beneficiaries must agree and sign.

- If the change increases someone else’s tax liability, that person must consent.

- It must be in writing and include certain statutory statements if it is intended for tax purposes.

When to seek professional advice

You should always consult a solicitor or tax adviser if:

- The estate is large or complex.

- There are potential tax implications.

- You’re unsure how the change could affect other beneficiaries or eligibility for state benefits.

Professional advice ensures the deed is drafted correctly and that HMRC receives the appropriate notifications.

Real-world example: Tax efficiency and family planning

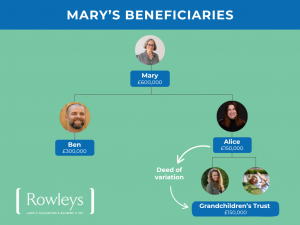

- Mary dies, leaving an estate worth £600,000. Her Will divides everything equally between her two adult children, Alice and Ben (£300,000 each).

- Because Mary’s estate falls within her inheritance tax allowances, no IHT is due.

Problem:

Alice is financially secure and already has a large estate. She worries that inheriting £300,000 will increase the eventual IHT on her own estate. She wants her two children, Mary’s grandchildren, to benefit now instead.

Solution: Deed of Variation

Alice signs a Deed of Variation redirecting £150,000 of her share into a trust for her children. The document is executed within two years of Mary’s death.

For tax purposes, HMRC treats the change as if Mary herself had left that £150,000 directly to her grandchildren.

Benefits:

- Reduces future IHT: Alice’s estate is now smaller, potentially reducing tax later.

- Tax-efficient giving: The transfer is treated as part of Mary’s estate, not a gift from Alice, so the usual 7-year gift rule does not apply.

- Supports the next generation: The grandchildren benefit sooner.

- No adverse effect on others: Ben still receives his £300,000, and Mary’s overall IHT position is unchanged.

Key considerations:

- All changes must be in writing and signed.

- If the trust arrangement affects tax, HMRC must be notified correctly.

- Alice must not receive any personal benefit from the variation (e.g., control over the trust for her own gain) or it could be disregarded for tax purposes.

Final thoughts

A Deed of Variation offers a rare second chance to make things right, whether that means reducing tax, supporting loved ones, or aligning the Will with a family’s true wishes.

Handled with care and proper advice, it can provide both financial and emotional peace of mind at a difficult time.

If you would like to discuss whether a Deed of Variation could be a useful tool for your circumstances, please get in touch, we’re here to help.